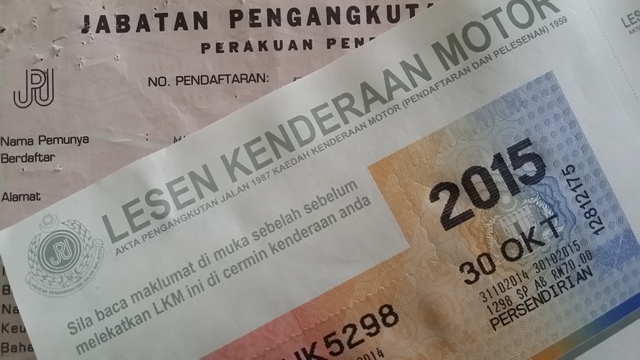

Road tax in Malaysia is an essential financial obligation for every vehicle owner. It not only serves as a source of revenue for the government but also plays a crucial role in the maintenance and development of the nation’s road infrastructure. To fully comprehend road tax and its intricacies, it is imperative to explore the concept of calculator insuran kereta, the significance of insurans etiqa kereta, and the process of calculating road tax.

The Role of Calculator Insuran Kereta

The term calculator insuran kereta may be unfamiliar to some, but it is a digital tool that has simplified the process of calculating road tax for vehicle owners in Malaysia. This tool takes into account various factors, including the type of vehicle, engine capacity, location, and other relevant variables, to provide an accurate estimate of road tax costs.

The calculator insuran kereta empowers vehicle owners with the ability to anticipate their financial commitments accurately. It eliminates the guesswork associated with road tax calculations and ensures that individuals can plan for this mandatory expense with precision. This digital innovation has made it easier for vehicle owners to fulfill their fiscal responsibilities.

Understanding Insurans Etiqa Kereta

Insurans etiqa kereta, on the other hand, represents a facet of car insurance. While it may not seem directly related to road tax, the two are interconnected in certain respects. Comprehensive car insurance, such as insurans etiqa kereta, often requires a profound understanding of a vehicle’s particulars, including its engine capacity. This is because road tax costs in Malaysia are influenced by engine capacity.

By having a comprehensive understanding of the insurans etiqa kereta policy terms and conditions, vehicle owners can ensure that they align their insurance coverage with their specific requirements and financial commitments, including road tax. While the focus of insurans etiqa kereta is primarily on providing coverage in case of accidents and unforeseen events, it indirectly influences the fiscal responsibilities associated with road tax.

Calculating Road Tax: A Fiscal Responsibility

The process of calculating road tax is not just a legal requirement; it is a critical aspect of responsible vehicle ownership. Road tax costs are intricately linked to the engine capacity of a vehicle, a progressive tax structure aimed at capturing the higher wear and tear imposed on the road network by larger engines.

To accurately calculate road tax, one must consider the vehicle’s particulars, including its engine capacity and location of registration. The calculations may also vary based on the type of vehicle, such as a motorcycle or a car. This process ensures that vehicle owners contribute their fair share to the maintenance and development of the nation’s road infrastructure.

The Interplay of Road Tax and Insurance

The intersection of calculator insuran kereta, insurans etiqa kereta, and the process of calculating road tax highlights the interplay between fiscal responsibility and insurance in Malaysia. While road tax serves as a mandatory financial obligation essential for the upkeep of the nation’s roads, car insurance, such as insurans etiqa kereta, safeguards vehicle owners against financial devastation in case of accidents and unforeseen incidents.

Comprehensive car insurance necessitates an in-depth understanding of a vehicle’s engine capacity, which directly influences road tax costs. This underscores the importance of aligning insurance coverage with specific requirements and financial commitments, ensuring that vehicle owners navigate the complex terrain of road tax and insurance with prudence.

In Conclusion: A Roadmap to Responsibility

Road tax in Malaysia is not merely a fiscal obligation; it is a vital component of responsible vehicle ownership. The utilization of tools like the calculator insuran kereta empowers vehicle owners to anticipate their financial commitments with precision. Understanding the intricacies of insurans etiqa kereta is equally important, as it indirectly influences the fiscal responsibilities associated with road tax.

In this complex landscape, knowledge is not just a virtue but a necessity. By comprehending the details of road tax, vehicle owners can ensure that they fulfill their fiscal responsibilities accurately and contribute to the maintenance and development of Malaysia’s road infrastructure. It is a journey marked by fiscal responsibility and insurance coverage that aligns seamlessly with individual needs and requirements.

More Stories

Haven’t Travelled in A While? Here’s Why You Should Just Start a Vacation Now

Discount Golf Vacation Package Tips – Don’t Gamble With Your Golf Vacation

India Wails in Villages